×

×

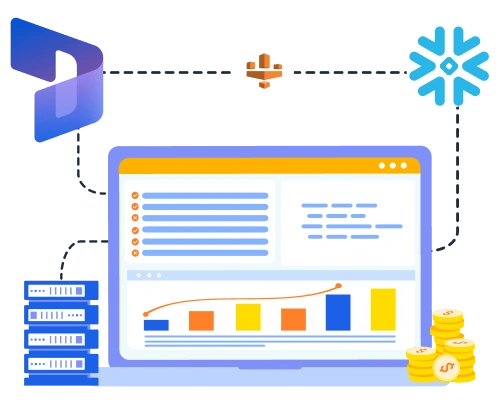

Dynamics 365 Finance Data Integration to Snowflake using AWS ETL

A well-established enterprise leveraged Microsoft Dynamics 365 Finance as its core system for managing general ledger, accounts payable, accounts receivable, and financial reporting. While the ERP system supported day-to-day accounting processes, the finance leadership team required a scalable analytics platform to enable faster financial close, historical analysis, and audit-ready reporting.

Customer Challenges

The client’s finance teams encountered multiple limitations when using Dynamics 365 Finance data for analytics and reporting. While the ERP system supported core accounting processes, it was not optimized for scalable analytics or close-cycle reporting demands.

Solutions

To enable scalable, reliable, and audit-ready financial analytics, a cloud-based ETL and analytics architecture was designed to integrate Dynamics 365 Finance data into Snowflake.

Finance data was extracted from Dynamics 365 Finance using REST APIs orchestrated through AWS Glue. The pipelines captured core financial entities, including general ledger, journals, and transactional finance data, with both full and incremental loads to support efficient data processing.

Automated ETL workflows were implemented to ensure reliable and repeatable data movement. Incremental processing reduced load times and enabled near real-time data availability for finance reporting, without impacting ERP performance.

Raw financial data was loaded into Amazon S3, creating a durable and auditable staging layer. This approach preserved source-level data, supported reprocessing and data replay, and provided a clear lineage from raw to curated datasets.

Data was loaded into a Snowflake Raw schema using Snowflake storage and file integrations. Stored procedures were used to transform raw data into curated, analytics-ready datasets within the Snowflake Reporting schema, applying standardized business rules and financial calculations.

A centralized Snowflake reporting schema ensured consistent definitions for key finance metrics such as balances, revenues, expenses, and period-based calculations. This eliminated metric discrepancies and established a single source of truth for financial reporting.

Power BI was used as the analytics layer to deliver interactive finance dashboards and reports. Semantic models were designed with standardized KPIs and financial hierarchies to support:

- P&L, balance sheet, cash flow, and trial balance reporting

- Slicing by period, legal entity, cost center, and account hierarchy

- Period-over-period, budget vs. actual, and year-to-date analysis using dynamic calculations

Credentials were securely managed using AWS Secrets Manager, while pipeline execution and failures were monitored through Amazon CloudWatch. Role-based access controls were enforced across Snowflake and Power BI to ensure finance stakeholders accessed only authorized datasets.

The centralized analytics model preserved relationships across Dynamics 365 Finance entities, enabling accurate rollups, hierarchical reporting, and reliable financial analysis in Power BI.

Services Used

Why choose NeenOpal?

NeenOpal combines deep expertise in Dynamics 365 Finance, AWS, Snowflake, and Power BI to deliver reliable, production-grade finance analytics platforms. With a strong focus on data governance, performance, and auditability, NeenOpal enables enterprises to transform their ERP data into trusted insights. The team’s proven approach to building scalable ETL pipelines and analytics-ready data models enables faster financial close, consistent reporting, and a future-ready foundation for advanced analytics.

Benefits

The Dynamics 365 Finance to Snowflake analytics platform delivered measurable improvements in reporting speed, data consistency, system performance, and audit readiness.

Conclusion

By integrating Dynamics 365 Finance data into Snowflake using a scalable AWS-based ETL architecture, the organization transformed its financial reporting and analytics capabilities. The solution improved close-cycle efficiency, ensured data consistency, and enabled audit-ready reporting, while laying a strong foundation for scalable and advanced finance analytics in the future.